Navigating Hurricane Milton Insurance Claims in Florida: A Comprehensive Legal Guide

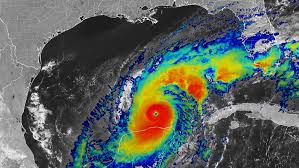

Hurricane Milton’s devastating impact on Florida’s Gulf Coast left thousands of homeowners facing significant property damage and complex insurance challenges. In the aftermath of such a catastrophic event, many residents find themselves struggling to secure fair compensation from their insurance providers. This comprehensive guide explores how Sarasota Hurricane Milton insurance dispute legal professionals can help homeowners navigate the intricate landscape of insurance claims and recover their rightful settlements.

Understanding the Complexity of Hurricane Damage Claims

When Hurricane Milton tore through Florida, it didn’t just cause physical destruction—it created a labyrinth of legal and financial challenges for homeowners. Insurance policies, which seem straightforward during calm times, suddenly become intricate documents filled with potential pitfalls and complex clauses. Many insurance companies employ sophisticated strategies to minimize payouts, leaving homeowners vulnerable and overwhelmed.

The Challenges Homeowners Face

Homeowners confronting Hurricane Milton’s aftermath typically encounter several significant obstacles:

- Extensive Property Damage Assessment: Determining the full extent of hurricane-related damage requires comprehensive professional evaluation. Structural issues, water damage, wind destruction, and secondary damage can be complex to document and quantify.

- Insurance Company Tactics: Insurers often employ delay tactics, undervalue claims, or outright deny legitimate claims. They might argue that certain damages fall outside policy coverage or require extensive documentation that can be challenging for homeowners to produce.

- Technical Policy Language: Insurance policies are laden with legal terminology that can be difficult for the average homeowner to interpret. Understanding the nuanced language can mean the difference between a fair settlement and inadequate compensation.

Why Professional Legal Representation Matters

Engaging a Tampa home insurance lawyer for Hurricane Milton damage can dramatically transform your insurance claim experience. These specialized attorneys bring multiple critical advantages to your case:

Comprehensive Claim Evaluation

Experienced insurance litigation attorneys conduct thorough assessments of your property damage, ensuring no aspect of your claim is overlooked. They collaborate with expert witnesses, including construction professionals, damage assessment specialists, and forensic accountants, to build a robust case.

Negotiation Expertise

Insurance companies have teams of skilled negotiators designed to minimize payouts. Tampa Bay Hurricane Milton insurance claim law firm professionals counter these tactics with strategic negotiation techniques, leveraging legal knowledge and extensive experience in insurance dispute resolution.

Litigation Support

If negotiations reach an impasse, your legal team can swiftly transition to litigation. They understand Florida’s specific insurance laws and can represent your interests in court, ensuring you have a powerful advocate fighting for fair compensation.

The Legal Process: What to Expect

When you engage an insurance litigation group for your Hurricane Milton claim, you can anticipate a structured, strategic approach:

- Initial Consultation: Attorneys will review your policy, damage documentation, and insurance correspondence.

- Comprehensive Damage Assessment: Professional experts will document and quantify all hurricane-related damages.

- Demand Letter Preparation: A detailed demand letter outlining your claim’s full scope will be drafted.

- Negotiation Phase: Your legal team will engage with the insurance company to secure a fair settlement.

- Potential Litigation: If necessary, your attorneys will file a lawsuit and represent you in court.

Choosing the Right Legal Representation

When selecting a St Petersburg claim dispute law firm for hurricane Milton, consider these critical factors:

- Proven track record in hurricane insurance claims

- Extensive knowledge of Florida insurance laws

- Strong network of damage assessment experts

- Transparent communication and fee structures

- Commitment to client advocacy

Financial Considerations

Most insurance litigation groups operate on a contingency fee basis, meaning they only get paid if they successfully recover compensation for you. This arrangement ensures alignment of interests and reduces upfront financial risks for homeowners.

Hurricane Milton’s aftermath presents significant challenges, but professional legal support can transform a potentially overwhelming experience into a manageable path toward recovery. By understanding your rights, documenting your damages meticulously, and partnering with experienced insurance litigation professionals, you can navigate the complex claims process with confidence.

Remember, time is of the essence in insurance claims. Florida has specific statutes of limitations for filing insurance disputes, so prompt action is crucial. Consult with a specialized insurance litigation attorney to protect your rights and secure the compensation you deserve.

Contact Insurance Litigation Group at at 888-ILG-4254 (1-888-454-4254) for a no-charge home inspection and damage assessment!

Let our experienced and aggressive adjusters and insurance attorneys help get you paid for your loss.