Understanding Construction Surety Bonds: Essential Services from Guignard Company in Tampa, FL

Text to voice sample

In the dynamic world of construction, where projects range from small-scale renovations to massive infrastructure developments, ensuring financial security and project completion is paramount. This is where surety bonds come into play, acting as a safeguard for all parties involved. Guignard Company, a leading agency for those seeking surety bond services, offers comprehensive solutions tailored to the needs of contractors, developers, and project owners. With a strong presence in Florida and Georgia, Guignard Company helps businesses navigate the complexities of bonding requirements for smooth project execution. In this in-depth article, we’ll explore the intricacies of construction bonds, bid bonds, performance bonds, and contract bonds, highlighting how Guignard Company’s years as a trusted, reliable surety bond agency can benefit your next venture, particularly in the Tampa area.

What Are Construction Surety Bonds?

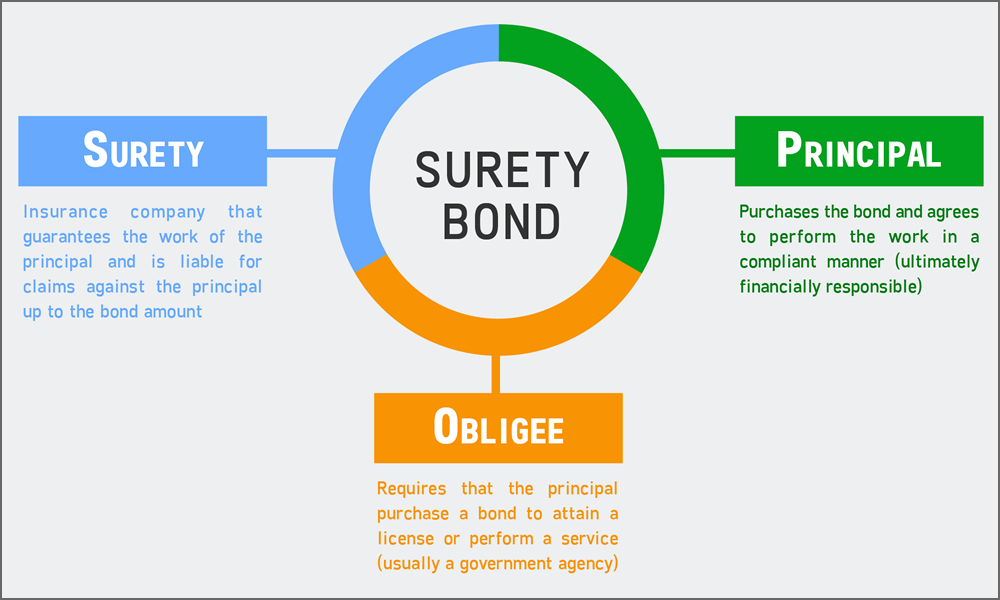

Construction surety bonds are financial instruments that guarantee the performance of a contractor of subcontractor on a construction project. Unlike traditional insurance, which protects the policyholder, surety bonds protect the project owner (obligee) from losses if the contractor (principal) fails to fulfill their obligations. The surety bond agency connects the principal with the surety bond company, a third party that provides assurance that the project will be completed in accordance with the contract terms.

These bonds are crucial in the construction industry because they mitigate risks associated with project delays, substandard work, or financial insolvency of the contractor. According to industry standards, surety bonds are often required for public projects funded by taxpayer dollars. They are increasingly common in private sector contracts as well. For contractors in Tampa, FL, where the construction boom is fueled by population growth and urban development, obtaining the right Tampa FL Construction surety bonds through a trusted agency is essential to bid on lucrative opportunities.

Guignard Company excels in guiding companies through the complicated process of evaluating the contractor’s financial stability, experience, and capacity. Guignard’s streamlines the application process so that contractors can secure bonds quickly without unnecessary delays. Whether you’re building residential complexes in Brandon or commercial spaces in downtown Tampa, Guignard Company’s local expertise makes them a go-to partner.

Diving Deeper into Bid Bonds

Contractors must submit bid bonds along with their bid proposals for construction projects. The bond’s primary purpose is to ensure that the contractor will honor its bid if selected for the project. If the contractor withdraws their bid afterward or fails to provide the required performance and payment bonds, the project owner can file a claim to cover the costs of re-bidding or selecting the next lowest bidder.

Typically, bid bonds are issued for 5-10% of the bid amount, serving as a deterrent against frivolous or insincere bids. In competitive markets like Tampa, where numerous contractors vie for projects, having reliable Tampa surety bid bond providers can make all the difference. Guignard Company stands out by helping contractors secure bid bonds at competitive rates and with fast approvals.

To illustrate, consider a scenario where a contractor in along Florida’s west coast bids on a municipal road improvement project. Without a bid bond, its proposal might be dismissed outright. Guignard Company’s team assists in preparing the necessary documentation for the bond application, including financial statements and project histories, to strengthen the application. This not only increases the chances of approval but also builds long-term relationships with sureties, leading to better terms on future bonds.

The Role of Performance Bonds in Project Success

Performance bonds guarantee that the contractor will complete the project according to the specifications outlined in the contract. If the contractor defaults, due to bankruptcy, poor workmanship, or other reasons, the surety company steps in to either complete the project itself or hire another contractor to do so.

Performance bonds typically cover 100% of the contract value, providing comprehensive protection to the obligee. For projects in the Tampa Bay area, where hurricanes and weather-related delays are common risks, a robust Tampa Bay FL performance bond provider like Guignard Company ensures that projects stay on track. Their bonds are backed by top-rated sureties, offering peace of mind to all stakeholders.

Performance bonds can speed dispute resolutions. When an issue arises, the surety investigates claims impartially, often preventing costly litigation. Guignard Company offers advisory services on contract management and risk mitigation, sometimes recommending milestone payments or quality control measures to reduce the likelihood of defaults.

Exploring Contract Bonds: The Umbrella of Protection

Contract bonds encompass a suite of surety bonds used in construction contracts, including bid bonds, performance bonds, and payment bonds. The last, often bundled with performance bonds, ensures that subcontractors, suppliers, and laborers are paid for their work and materials. The assurance of payment can dissuade affected parties from filing mechanics’ liens and thus maintain project momentum.

In metro Atlanta, where commercial development is surging, finding a dependable bid bond agency is vital for contractors handling large-scale projects. Guignard Company’s Tampa and Alpharetta offices specialize in customizing contract bond packages to meet specific project needs, whether it’s a federal highway contract or a private office building.

Contract bonds are regulated by bodies like the Miller Act for federal projects, requiring bonds for contracts over $100,000. Guignard Company navigates these regulations seamlessly, helping contractors comply while minimizing costs. Their approach includes support on credit analysis and capacity building, enabling smaller firms to compete with larger ones.

Benefits of Partnering with Guignard Company

Choosing Guignard Company as your surety bond agency offers numerous advantages. As a Top Florida surety bond agency, it provides personalized service, leveraging deep industry knowledge to secure the best rates. Its friendly application process speeds the entry of basic information like name, type of bond, and address, as outlined on their website.

Guignard Company’s commitment to efficiency means no project is delayed due to bonding issues. It offers resources such as bond calculators and educational webinars, empowering clients to make informed decisions. In metro Atlanta, for example, its local presence allows for in-person consultations, fostering trust and collaboration.

Moreover, Guignard Company’s surety programs are designed for long-term success. By building a strong bonding line, contractors can take on larger projects, expanding their business. Testimonials from satisfied clients highlight their responsiveness and expertise, with many noting significant cost savings.

Case Studies: Real-World Applications

To demonstrate the value of these bonds, let’s examine a few case studies. In Tampa, many contractors have secured multi-million performance bonds through Guignard Company for waterfront developments. When supply chain issues arose, the bond ensured the project continued without interruption, saving the owner from potential losses.

In Orlando, many contractors have seen that with Guignard’s bonding support they have been able to secure multi-million dollar contracts. Guignard Company’s quick turnaround allowed the bid to be submitted on time, leading to a successful contract award.

At another time, contract bonds protected a tech campus build, covering payments to over 50 subcontractors. This comprehensive coverage prevented disputes and ensured timely project completion.

These examples underscore how Guignard Company’s services translate into tangible results, enhancing project outcomes across regions.

How to Get Started with Guignard Company

Initiating the bonding process with Guignard Company is straightforward. Visit their website or contact one of their offices to submit your information. Their team will guide you through underwriting, which assesses your financial health and project viability.

For optimal results, prepare detailed financials, references, and project plans. Guignard Company offers pre-qualification services to gauge your bonding capacity upfront.

Common Challenges and Solutions

Contractors often face challenges like high premiums or denials due to credit issues. Guignard Company addresses these by partnering with multiple sureties and offering credit improvement advice.

In volatile markets, bond availability can fluctuate. Guignard Company’s strong relationships ensure consistent access.

The Future of Surety Bonds in Construction

Looking ahead, surety bonds will evolve with technology, incorporating digital underwriting and blockchain for transparency. Guignard Company is at the forefront, adopting these innovations to streamline its agency services.

Sustainability will also play a role, with bonds potentially incentivizing green practices. Guignard Company supports contractors with eco-friendly projects, aligning with industry trends.

Construction surety bonds, including bid, performance, and contract bonds, are indispensable for risk management in the building sector. Guignard Company provides top-tier services in Tampa, Orlando, and Alpharetta, ensuring projects in those markets succeed.

For more information, contact Guignard Company at:

Orlando Office: 1904 Boothe Circle Longwood, FL 32750 407-834-0022

Tampa Office: 1219 Millennium Pkwy, Ste 113 Brandon, FL 33511 813-547-3773

Atlanta Office: Deerfield Corporate Center One 13010 Morris Rd Ste 600, Alpharetta, GA 30004 678-606-5533