Guignard Company Leads the Way in Securing Construction Contract Bonds for Florida’s Commercial Projects

FOR IMMEDIATE RELEASE

Orlando, FL – May 28, 2025 – Florida’s commercial construction industry is thriving, with projects transforming skylines from Tampa to Sarasota. However, securing contracts for these high-stakes developments requires more than expertise—it demands construction contract bonds like Bid Bonds, Performance Bonds, and Payment Bonds to ensure trust and accountability. Guignard Company, a premier provider of commercial construction surety bond providers in FL, is empowering contractors across Tampa, Orlando, Southwest Florida, and beyond with expert surety bond solutions. With offices in Orlando (1904 Boothe Circle, Longwood, FL 32750), Tampa (1219 Millennium Parkway Suite 113, Brandon, FL 33511), and Atlanta (Buford, GA 30518), Guignard is a trusted partner for contractors navigating the complex bonding process.

The Critical Role of Construction Contract Bonds

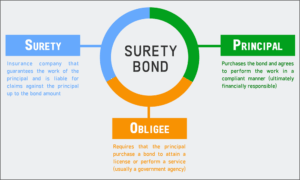

Construction contract bonds are essential for commercial projects, providing financial security and fostering confidence among project stakeholders:

- Bid Bonds: These guarantee that contractors will honor their bids if selected, ensuring they can provide the required Performance and Payment Bonds. Bid Bonds maintain fairness in the bidding process, preventing frivolous offers.

- Performance Bonds: These ensure contractors complete projects according to contract terms, protecting owners from delays or defaults by covering costs to hire replacements if needed.

- Payment Bonds: These secure payment for subcontractors, laborers, and suppliers, encouraging their participation and safeguarding against financial disputes.

In Florida, where public and large private projects often mandate these bonds, they are a prerequisite for securing contracts. Bonds demonstrate a contractor’s reliability, aligning with state regulations and industry standards, and are critical for projects like office complexes, retail centers, and industrial facilities.

Challenges in Obtaining Construction Contract Bonds

Securing these bonds is a complex and challenging process, particularly for small or emerging contractors. Key obstacles include:

- Stringent Financial Requirements: Surety companies scrutinize a contractor’s financial health, requiring strong credit scores, robust cash flow, and detailed financial statements. New or smaller firms often struggle to meet these criteria, facing denials or high premiums.

- Cost Barriers: Bond premiums (1-3% of the bond amount) and potential collateral requirements can strain budgets, especially for contractors tackling large projects with limited resources.

- Rigorous Underwriting: Sureties evaluate a contractor’s experience, project history, and capacity, which can disadvantage firms with limited portfolios or past claims.

- Florida-Specific Risks: Hurricanes, labor shortages, and rising material costs increase project risks, leading sureties to impose stricter standards in Florida’s dynamic construction market.

These hurdles can prevent contractors from bidding on lucrative projects, limiting their growth in a competitive industry.

Guignard Company’s Expertise and Services

Since its founding in 1987, Guignard Company has established itself as a leader among surety bonds providers in Florida, offering tailored solutions for contractors in Tampa, Orlando, Southwest Florida, and beyond, with an additional office in Atlanta (Buford, GA 30518). Their comprehensive services include:

- Customized Bonding Solutions: Guignard provides Bid, Performance, and Payment Bonds, working closely with contractors to meet project-specific requirements.

- Financial Guidance: Their team assists contractors in preparing financial documentation, enhancing bondability even for those with challenging credit profiles.

- Competitive Premiums: Leveraging strong relationships with top surety underwriters, Guignard secures cost-effective rates, reducing financial burdens.

- Regional Expertise: From southwest FL surety bonds for construction to Tampa surety bond companies, central FL surety bond company for construction, and Sarasota surety bond providers, Guignard serves contractors across Florida’s diverse regions.

Guignard’s history of reliability and client-focused service has made it a trusted name in the industry. Their deep understanding of Florida’s construction landscape—coupled with their Atlanta office—ensures contractors receive personalized support tailored to regional needs.

Why Choose Guignard Company?

Guignard Company’s commitment to excellence enables contractors to secure bonds efficiently, opening doors to larger projects and fostering growth. Their services not only address bonding challenges but also provide peace of mind, allowing contractors to focus on delivering quality work. In Florida’s competitive market, partnering with Guignard is a strategic advantage for contractors aiming to stand out.

Contact:

Guignard Company

(888) 220-3780

Orlando Office: 1904 Boothe Circle, Longwood, FL 32750

Tampa Office: 1219 Millennium Parkway Suite 113, Brandon, FL 33511

Atlanta Office: Buford, GA 30518

Don’t let bonding challenges derail your next project. Contact Guignard Company at (888) 220-3780 or visit their offices in Orlando (1904 Boothe Circle, Longwood, FL 32750), Tampa (1219 Millennium Parkway Suite 113, Brandon, FL 33511), or Atlanta (Buford, GA 30518). Explore their surety bond solutions at https://guignardcompany.com/ and call today to secure your competitive edge!